Even though these are money market funds, each will have different levels of risk and different expenses that will affect the return. Please discuss your particular needs and circumstances with your BOKFS Financial Advisor to determine which fund is best suited for your investment needs. BOKF, NA also provides shareholder services and receives custody and shareholder service fees for providing these services to Cavanal Hill Funds.

BOKFS serves as the distributor for Cavanal Hill Funds and BOKF, NA serves as the custodial bank. This compensation will be earned by Cavanal Hill Funds, Cavanal Hill Investment Management, BOK Financial Securities, Inc.

/media/img/prizes/prizegrab-3333-sweepstakes.jpg)

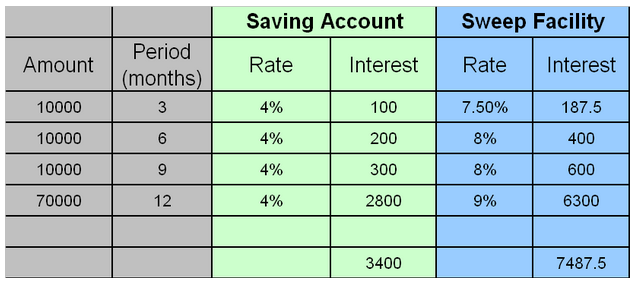

The Cavanal Hill Funds are also listed on Appendix A.īecause Cavanal Hill Funds are affiliated with BOKFS, BOKFS and its affiliates will earn direct and indirect compensation when you choose a Cavanal Hill Fund. Our brokerage and advisory accounts are custodied at Pershing.īOKFS has entered into additional agreements with Pershing for the distribution of certain money market funds (“Cavanal Hill Funds”) operated by Cavanal Hill Investment Management, Inc., an affiliate of BOKFS. Pershing, LLC is a wholly owned subsidiary of The Bank of New York Mellon Corporation (BNY Mellon) and a member of FINRA, the New York Stock Exchange (NYSE) and SIPC. Each fund has a different investment approach and may provide added benefits to investors. BOKFS may change these funds with 30 days written notice. The money market funds available to choose from are listed in Appendix A. If you choose to link your account(s) to a Fund, your available cash balances are swept to the Fund upon settlement. You may select one of these money market funds to be linked to your BOKFS account. The rate of return on any of the sweep vehicles offered may be lower than that of similar investments offered outside of this program.īOKFS has entered into an agreement with Pershing, LLC ("Pershing") for the distribution of certain money market funds ("Fund"). Current rates and minimum investment amounts may be obtained from your Financial Advisor There is no guarantee that the yield on any particular cash sweep will remain higher than others over any given period of time. The rates of return you will earn vary over time and by the program and money market fund you choose. Rates of Return and Minimum Investment Amounts The funds are automatically placed (“swept”) into a sweep vehicle until such balances are invested by you or otherwise needed to satisfy obligations in connection with your account. Why choose a sweep account? Our cash sweep program allows you to earn a return on the uninvested cash balances for which no interest is otherwise earned or paid. For the FDIC Insured Bank Deposit Program, there is only one selection. Within the Money Market Sweep Program, you may choose from a varied selection of available money market funds. There are two choices: the Money Market Sweep Program or the FDIC Insured Bank Deposit Program. ("BOKFS") provides our customers with the convenience of sweeping available cash from your brokerage account into one or more investment or depository vehicles upon settlement.

Sweep Choices.īOK Financial Securities, Inc. The prospectus, which contains this and other important information, is available from your Financial Advisor and should be read carefully before investing. Investors should consider the investment objective, risks, charges, and expenses carefully before investing. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund. Money Market Fund and FDIC Insured ChoicesĪn investment in a money market fund (“Fund”) is neither insured nor guaranteed by the FDIC or any other government agency.

0 kommentar(er)

0 kommentar(er)